Donation

The Ramakrishna Math, Ooty, welcomes the public to take part in carrying out various types of work chalked out by Swami Vivekananda for serving humanity. Those who wish to offer their voluntary services may contact the Math Office. Admirers and devotees, who are in sympathy with the objects but are unable to take part in our activities, are cordially invited to help us by contributing to one or more of the Funds, which need their active support.

Donations to Ramakrishna Math, Ooty exempt from income tax under Section 80G of the IT Act, 1961 (Applicable only to Indian donors).

Ramakrishna Math, Ooty will be completing 100 years in 2026. We invite donations from Devotees and Other Organisations to donate liberally to celebrate the Centenary in a befitting Manner.

Donations from Indian Citizens

PAN (or) Aadhaar Number is required for donations below ₹10,000; PAN is mandatory for donations above ₹10,000. Enter PAN in UPPERCASE.

As per Rule No. 18AB of the Income-Tax (6th Amendment ) Rules 2021, which has come into force from 1st April 2021, every donor has to provide an ID Number irrespective of the donor's wish either to claim or to forego the tax exemption.

You will receive an 80G donation receipt, after successful transaction. Please make sure to enter the correct details – Name, Address, Email ID, PAN or Aadhaar No. If the email id is mistyped, you may not receive the donation receipt email.

If the transaction is successful and you don't see the email in your inbox you may please check your junk/spam folder.

Donations from Indian Citizens

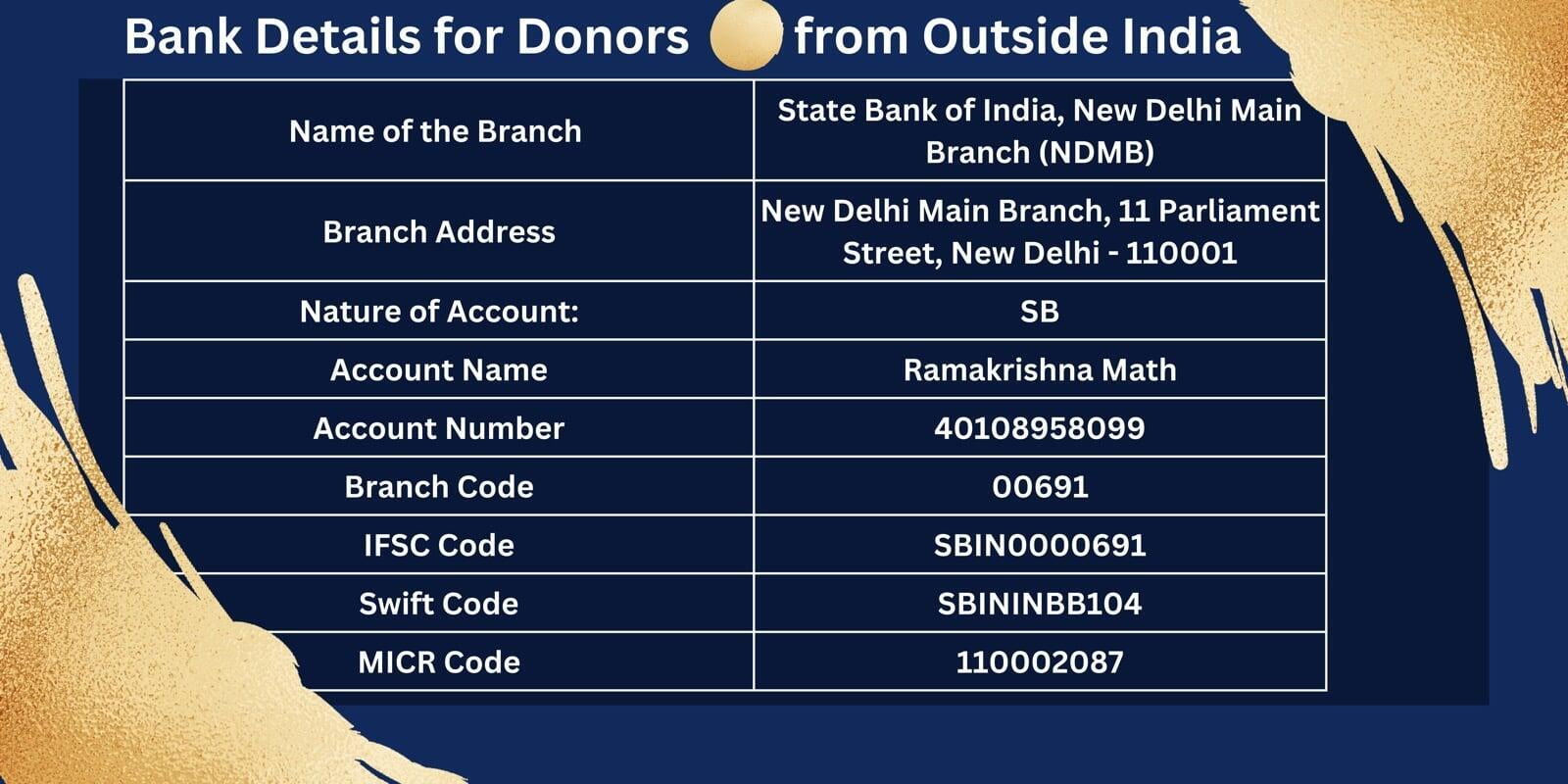

Donations from Foreign Citizens

Passport Number / Tax Identification Number is mandatory.As per the Foreign Contribution (Regulation) Act 2010, of India, accepting donations from an Indian citizen in the FC account will be a major violation of FCRA 2010. It will create a problem for us from the Ministry of Home Affairs, Government of India. Citizenship is the key point for ascertaining a contribution whether it is Foreign Contribution or an Indian Contribution.

You will receive donation receipt, after successful transaction. Please make sure to enter the correct details – Name, Address, Email id. If the email id is mistyped, you may not receive the donation receipt email.If the transaction is successful and you don't see the email in your inbox you may please check your junk/spam folder.

Donations from Foreign Citizens

Some of our Major Activities which need your support

Temple – Puja and Seva

Daily Worship, Offering, etc

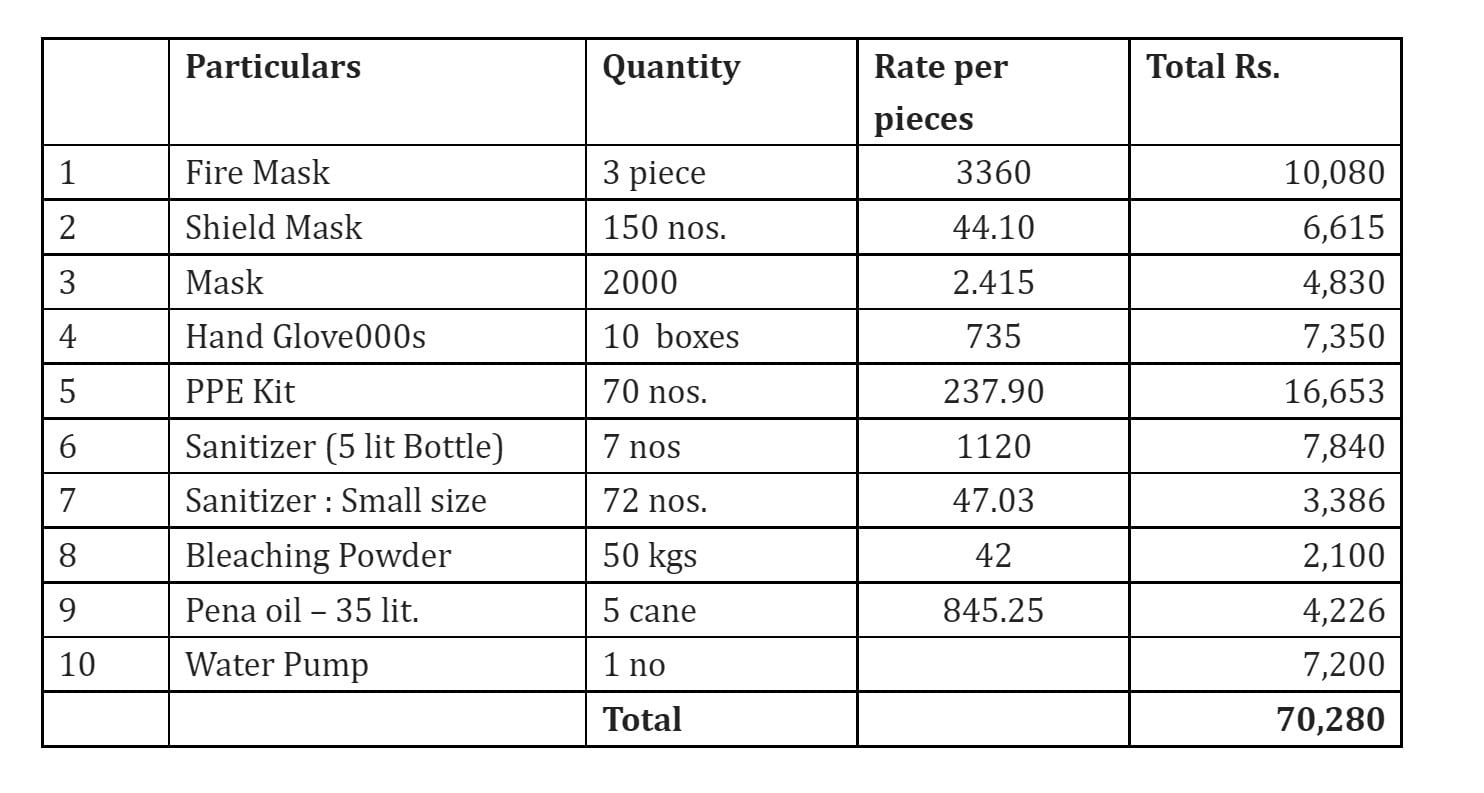

Covid Relief

Celebration and Titi Puja

Winter Relief

Pecuniary Help

Scholarships

Inter School Sports Competitions

Centenary Celebrations

Inter School Cultural Competitions